UK advertising spend rose 6.3% to reach £23.6bn in 2018, marking the ninth consecutive year of industry growth and highest annual total since monitoring began. The results follow a rise of 5.7% during the fourth quarter of last year, with adspend reaching £6.5bn – once again, a new high.

The data are included in the latest AA/WARC Expenditure Report, published yesterday. On behalf of the UK’s Advertising Association, WARC has monitored advertising spend each quarter since 1982. For the most, data are collected directly from media owners, either by WARC through our survey of publishers, or via industry bodies such as Radiocentre, Outsmart and the IAB. This unique approach allows us to present the most accurate market data available, enabling a transparent and reliable measure of industry health.

We believe that the UK’s ad market will grow 4.8% this year, and a further rise, of 5.5%, is projected for 2020. This would push total market value to over £26bn, and complete more than a decade of continuous growth.

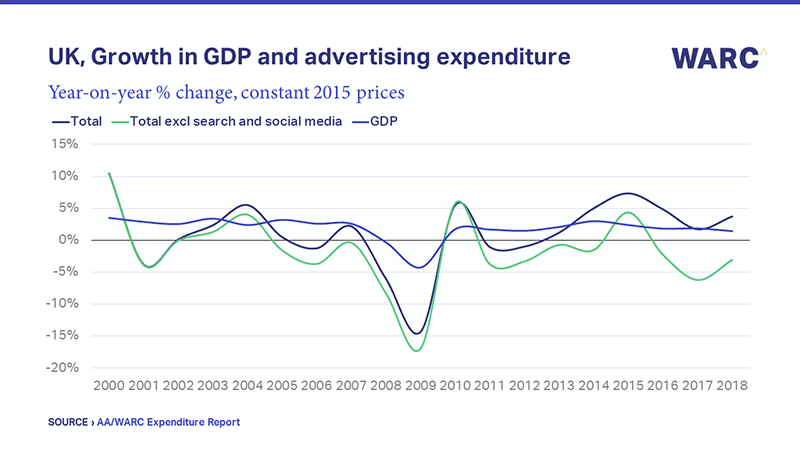

While the UK’s economy is expected to expand by 1.2% this year and 1.4% in 2020, these rates are around half the average for the 20-year period leading up to the financial crisis in 2008. As such, they would normally be associated with limited adspend increases, but in recent years we have seen the UK’s advertising market growing noticeably faster than the state of the UK economy would suggest.

Despite most traditional media being stagnant or in decline, the UK’s ad market grew at its strongest rate since 2015 last year. The growth was primarily driven by rapidly rising investment in paid search (up 14.3% to £6.7bn in 2018) and online display formats (up 21.4% to £5.3bn), particularly social media and, by extension, online video (80% of online video spend is paid to social platforms).

Search and social media draw two in every five pounds spent on advertising today and, as such, the fortunes of the media owners which control these formats have a major bearing on total market growth. Indeed, UK advertising spend excluding search and social media has dipped in four of the last five years, or seven of the last eight after accounting for inflation.

Search in particular is a sales-driven format, leveraged by brands looking to reach consumers closer to the point of purchase, be they browsing online or interacting with a voice assistant. Rapidly increasing investment here may signal an element of, somewhat understandable, short-termism during politically uncertain times. Indeed, in absolute terms, investment in paid search rose by more last year than it did in 2017.

Meanwhile, absolute growth in social media spend was just £12m lower than in 2017 (the highest absolute rise on record) – potentially the result of recent scandals in the sector. As with paid search, social media ad buying is inherently programmatic, allowing advertisers to pair their messaging with internet users based on their digital footprint. These tools are also accessible, enabling a long-tail of SMEs to invest, and this has transformed the DNA of advertising in recent years.

The remaining, declining, 60% of UK advertising spend is shared between legacy media owners whose platforms have, for the most, struggled to maintain consistent levels of ad income. TV spots, synonymous with longer-term brand building, have recorded dips in investment over the last two years, while ad revenue among print publishers has fallen by more than a billion pounds over the last five. Radio was the only non-digital ad medium to grow last year.

Aside from ‘traditional’ media, online publishers are also struggling as a result of the concentration of ad money in paid search and social media formats. Globally, WARC believes that the pool of ad money available to online publishers beyond Google and Facebook will shrink for the first time this year.

In the UK, both national newsbrands and magazine brands recorded annual dips in digital ad income in 2018, with declines recorded across online display and online classified formats.

More encouragingly, two of the star performers in 2018 were unique digital formats: broadcaster video-on-demand (BVOD) and digital out of home (DOOH). The BVOD market rose 29.4% to £391m last year, on a par with the wider online video market, and further double-digit growth is forecast this year and next.

DOOH spend surpassed that for traditional panels for the first time in Q3 2018, and full-year spend rose 14.7% to £603m. We believe digital panels will account for the majority of spend, and the entirety of growth, in the out of home market this year.

But, for context, the combined value of BVOD and DOOH is just two-thirds the amount search and social media grew in a single year. The concentration of advertising money in two formats and, by extension, two media owners, is fuelling total ad market growth, but it may well belie the health of the industry at large.