Rob Meyerson was struggling to fully grasp some of the assertions in Byron Sharp's books, so he started digging into the underlying scientific research. Here’s what he learned so far.

It’s been about 10 years since the publication of How Brands Grow by Dr. Byron Sharp of the Ehrenberg-Bass Institute. The book is a MythBusters for branding and marketing, taking aim at the conventional wisdom of an industry that’s largely eschewed science and evidence-based theories in favor of maxims masquerading as immutable laws.

Among the book’s contributions to marketing are revelations such as:

- Consumers are not “deeply committed buyers” but “uncaring cognitive misers.” (Where can I get a t-shirt with this phrase on it?)

- Brands grow more through market penetration than by targeting “brand loyals” (i.e., existing customers).

- Ads should focus on “refreshing and building memory structures” rather than persuasion.

I’ve long been skeptical of many of the so-called tenets of brand strategy I was taught on the agency side – not because I think they’re wrong, necessarily, but because I’ve been asked to trust in them without any evidence.

So, when Sharp and his book came along promising the receipts, I was ready to read –and to let go of some long-held convictions.

Differentiation vs distinctiveness

While most of the book immediately rings true, one of its central assertions – that “rather than striving for meaningful, perceived differentiation, marketers should seek meaningless distinctiveness” – left me scratching my head.

First, I was confused by the language. Every brand consultancy I’ve ever worked at has used “differentiated” and “distinctive” interchangeably.

In Sharp’s and chapter co-author Dr. Jenni Romaniuk’s words, differentiation “has to be perceived by customers” and “must be valued.” It can include anything from product features – even meaningless ones – to more symbolic or emotional attributes.

Distinctiveness, on the other hand, is about helping customers “easily, and without confusion, identify” the brand. Unique brand names, logos, taglines, and colors all make a brand recognizable and distinctive, even if they convey little or no meaning. I suppose Sharp and Romaniuk may have chosen these words as an allusion to distinction without a difference – a logical fallacy in which someone draws a distinction between two things that have no meaningful difference (e.g., “I’m not getting fatter, I’m just less skinny than I used to be”).

To me, those definitions leave plenty of room for overlap. As marketing professor Mark Ritson points out, “in many cases […] the source of the differentiated association […] and distinctive codes [are] directly linked together.”

Take Philips’ Ambilight TV, which features intelligent LEDs around the screen’s edge to light up the room. It’s a trademarked brand name that features on packaging – it has all the trappings of a distinctive asset. Yet, presumably, customers perceive and value this feature – at least as much as Folgers coffee drinkers value “flaked coffee crystals” (cited by Sharp and Romaniuk as an “excellent example” of differentiation).

Philips Ambilight TV – distinctiveness or differentiation?

Are these intelligent LEDs a differentiating product feature, a distinctive asset, or both? If I’m understanding Sharp and Romaniuk’s definitions correctly, that depends on whether consumers consciously perceive Ambilight TVs as different in a meaningful or valuable way. In other words, differentiation is not an intrinsic characteristic of a brand; differentiation is in the eye of the consumer.

Behind the research

One key text the authors cite is an earlier piece of work from 2007: Evidence concerning the importance of perceived brand differentiation (Romaniuk, Sharp & Ehrenberg, 2007). In the research method section of their paper, the authors explain how they conducted their work.

“To examine consumer perceptions of differentiation, we draw on data that asks consumers directly how different or unique they perceive the brand to be.”

In effect, they asked people ‘would you describe this brand as different?’.

There are issues in this method. First, the question is unnatural. If you ask me why I buy a lot of Apple products, I’d say it’s because I think they’re well designed and well made. But would I select different in a survey? Probably not.

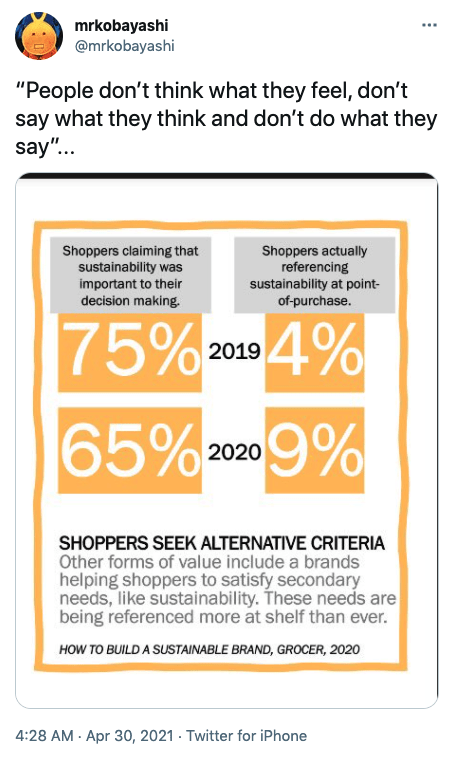

Self-reporting is also problematic. As marketers are quick to point out in other contexts, such as reports with headlines like “Millennials prefer sustainable brands,” self-reporting does not reliably reflect real-world buying behavior.

Doesn’t the same criticism apply to Romaniuk, Sharp & Ehrenberg’s paper? Even if people say they don’t think of a brand as different in a survey, they may still have a unique set of associations with that brand (e.g., well designed and well made). And maybe they buy the brand because of those associations.

But another passage in the book chapter caught my eye: “More successful brands do not have proportionally more unique associations, nor do customers with greater preference for a brand hold more unique associations than those with less preference.”

These observations come from another Romaniuk paper, co-authored with Elise Gaillard, entitled The relationship between unique brand associations, brand usage and brand performance: analysis across eight categories. In this study, the authors provided respondents with a “self-completion booklet” that contained 94 brands across eight categories (e.g., yogurt, soft drinks, computers). For each brand, participants were shown 43 attributes (like ‘alluring’, ‘fashionable’, and ‘good for you’) and asked to select as many as they felt applied.

Contrary to their hypotheses, the researchers found that “unique associations do not have any greater value in the consumer choice process than shared associations” and that larger, presumably more successful, brands “did not have a greater share of unique associations than smaller brands.”

This paper makes a much stronger case that branding professionals overestimate the importance of unique brand attributes (i.e., differentiation). But here, too, I have doubts about the scientists’ methodological decisions, and again they lie partly in semantics. For example, Romaniuk and Gaillard use the word “unique” literally, meaning an attribute like “friendly” is only counted as unique to Coke when someone marks none of the other 18 soda brands in the study as friendly. (As far as I can tell, if two brands are marked as friendly, that finding is ignored because “friendly” is not literally unique to either of those two brands.)

A more realistic example of brands competing based on differentiating attributes, in my opinion, would be something like “I’m in the mood for a Coke or a Sprite. I’ll choose Sprite because it’s more refreshing.” A subset of category brands and a selection based on the relative strength of an attribute, not a perception that only one brand exhibits it.

What I have learned

These are just two of the many papers that support the view that brands should worry less about differentiation and more about distinctiveness.

I’m sure other evidence exists, and maybe some of it is even more compelling. I’m also open to the possibility that I’ve misinterpreted or simply missed important results in these papers.

But based on the evidence presented in these two studies, the indictment of differentiation is limited to the following, specific findings:

- When consumers associate an attribute with one (and only one) brand in a category, that association is not correlated with consumers identifying that brand as “the one I prefer to use” (versus “one of several I prefer to buy”);

- People who say they buy a brand are not more likely to associate attributes with that brand and only that brand (i.e., literally unique associations);

- The fact that more consumers associate attributes with one (and only one) brand in a category does not lead (or correlate) to that brand having higher penetration (proportion of consumers who claim to use a brand); and

- Consumers are not all that likely to explicitly describe brands as distinctive or unique (or, perhaps, to perceive brands that way).

When phrased this way – and I believe I’ve accurately characterized the researchers’ work – the results are far less surprising than the broad assertion that differentiation is not very important in branding. Either these findings have been over-zealously interpreted or I just have more reading to do.

To be clear, Romaniuk and Sharp never say differentiation is worthless, just that it “plays a more limited role in brand competition than the orthodox literature assumes.” And that’s almost certainly true.

At the end of the Romaniuk and Gaillard paper, the authors recommend that future studies use “other techniques” like “direct questioning about the characteristics that consumers consider […] unique about brands.” That sounds like a step in the right direction. They also cite multiple papers that present evidence in support of differentiation’s value (e.g., Alpert, Kamins and Graham, 1992). So, I’ll keep digging. In the meantime, I remain skeptical. The report of differentiation’s death may have been an exaggeration.