A strong Q1 for UK adspend, but inflation is biting | WARC | The Feed

The Feed

Read daily effectiveness insights and the latest marketing news, curated by WARC’s editors.

You didn’t return any results. Please clear your filters.

A strong Q1 for UK adspend, but inflation is biting

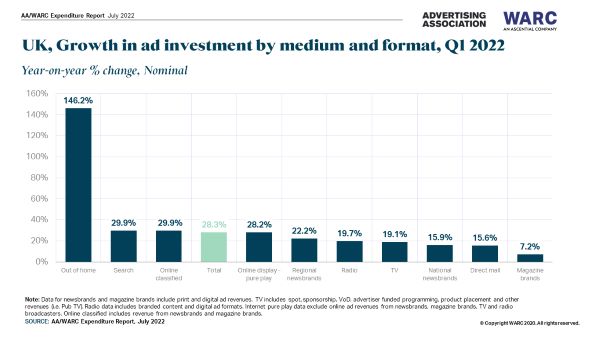

UK adspend rose 28.3% to a total of £8.6bn in the first three months of 2022, according to the latest AA/WARC Expenditure Report – that’s 7.7 percentage points ahead of the previous forecast in April.

The inflationary context

While a rebound was expected in Q1 2022 as all media recovered in comparison to the lockdowns of Q1 2021, the actual results outperformed expectations. The outlook for the total UK advertising market in 2022 has now been upgraded (+0.2pp) to 10.9% growth, by when adspend is set to reach a new high of £35.4bn. These figures also reflect the consistent growth of online advertising, which is forecast to account for 74.3% of all spend this year, in comparison to 73.5% in 2021.

Despite encouraging growth across most sectors, real growth in the UK’s ad market is expected to be just 1.8% this year when accounting for inflation. Nominal spend is forecast to rise by a further 4.4% in 2023, though, sustaining the market’s post-Covid recovery into next year.

The full picture in Q1 2022

- Online formats – notably search (+29.9%), display, including social (+27.6%) and classified (+29.9%) – grew the most in absolute terms, as market share reached 74.9% for online channels combined.

- A triple-digit recovery was seen in OOH (+146.2%) while cinema bounced back from zero spending in Q1 2021 and is forecast to register a 191.2% increase across the whole year.

- Overall increases at TV (+19.1%), radio (+19.7%) were driven by spending in the online sphere (VOD +25.9%, online radio +24.8%)

- National (+15.9%) and regional (+22.2%) news brands saw respectable increases in spending, while magazine brands (+7.2%) were rather slower; again, online spending was the main driver of growth.

WARC says

“While nominal growth is forecast this year and next, higher costs will carve into advertisers’ margins. This equates to a real term rise of 1.8% in ad investment this year – compared to a pre-Covid average of +2.6% – with inflationary pressures likely to sustain into 2023” – James McDonald, Director of Data, Intelligence & Forecasting, WARC.

Sourced from WARC, Advertising Association

Email this content